FOREX - the foreign exchange market or currency market or Forex is the market where one currency is traded for another. It is one of the largest markets in the world.

Some of the participants in this market are simply seeking to exchange a foreign currency for their own, like multinational corporations which must pay wages and other expenses in different nations than they sell products in. However, a large part of the market is made up of currency traders, who speculate on movements in exchange rates, much like others would speculate on movements of stock prices. Currency traders try to take advantage of even small fluctuations in exchange rates.

In the foreign exchange market there is little or no 'inside information'. Exchange rate fluctuations are usually caused by actual monetary flows as well as anticipations on global macroeconomic conditions. Significant news is released publicly so, at least in theory, everyone in the world receives the same news at the same time.

Currencies are traded against one another. Each pair of currencies thus constitutes an individual product and is traditionally noted XXX/YYY, where YYY is the ISO 4217 international three-letter code of the currency into which the price of one unit of XXX currency is expressed. For instance, EUR/USD is the price of the euro expressed in US dollars, as in 1 euro = 1.2045 dollar.

Unlike stocks and futures exchange, foreign exchange is indeed an interbank, over-the-counter (OTC) market which means there is no single universal exchange for specific currency pair. The foreign exchange market operates 24 hours per day throughout the week between individuals with forex brokers, brokers with banks, and banks with banks. If the European session is ended the Asian session or US session will start, so all world currencies can be continually in trade. Traders can react to news when it breaks, rather than waiting for the market to open, as is the case with most other markets.

Average daily international foreign exchange trading volume was $1.9 trillion in April 2004 according to the BIS study.

Like any market there is a bid/offer spread (difference between buying price and selling price). On major currency crosses, the difference between the price at which a market maker will sell ("ask", or "offer") to a wholesale customer and the price at which the same market-maker will buy ("bid") from the same wholesale customer is minimal, usually only 1 or 2 pips. In the EUR/USD price of 1.4238 a pip would be the '8' at the end. So the bid/ask quote of EUR/USD might be 1.4238/1.4239.

This, of course, does not apply to retail customers. Most individual currency speculators will trade using a broker which will typically have a spread marked up to say 3-20 pips (so in our example 1.4237/1.4239 or 1.423/1.425). The broker will give their clients often huge amounts of margin, thereby facilitating clients spending more money on the bid/ask spread. The brokers are not regulated by the U.S. Securities and Exchange Commission (since they do not sell securities), so they are not bound by the same margin limits as stock brokerages. They do not typically charge margin interest, however since currency trades must be settled in 2 days, they will "resettle" open positions (again collecting the bid/ask spread).

Individual currency speculators can work during the day and trade in the evenings, taking advantage of the market's 24 hours long trading day.

ip tracer

Amazon Deals

arain search engine

There are many many advantages over the various other ways of investing. First of all it is a 24 hr market, except for weekends of course. You have the US market then the european and then the Asian. One of the great times to trade is during the over lapping periods. The USA and european overlap between 5am & 9am eastern and the Euro & Asian between 11pm & 1am eastern. Usually the busiest time and best to trade.

The is also the risk factor for the accounts. With futures and options you can get margin calls that can wipe you out. If you get caught in a bad trade not only do you lose the money in the account but you may have to come up with alot more from your pocket. It can be very risking. But not in Forex. Worst case senerio you could lose whats in you account. But you would have to do something really stupid. Like making a big trade on a Fundamental day and leave it alone. If market takes a bad move and you weren't there. OOOPS. But That wouldn't happen with a smarth trader.

Then there are the demo accounts which is an account where you can trade using all the right things, platform,charts,and information. But you are using play money, or what we call paper trading too.

Plus with Forex you have a mini account. Instead of needing thousands of dollars to get into it. You can open an account with as little as $300.00. Now of course you will be trading at 1 tenth of a trade. IN other words you controling 10,000 instead of 100,000.00 These are call lots. Which also means you will only risk 1 tenth too!

So if you would love to learn to do investing and not have near the risk you really need to take a closer look at Forex trading.

Investing in foreign currencies is a relatively new avenue of investing. There are considerably fewer people are aware of this market than there are people aware of several other avenues of investing. Trading foreign currency, also known as forex, is the most lucrative investment market that exists. There are several factors that make this true among which, successful forex traders earn realistic profits of one hundred plus percent each month. Compared to some of the better known investment markets such as corporate stocks, this is an unheard of return on investment. It's very necessary to mention here that a person who invests in forex must, without exception, make it a point to learn the detailed, but simple strategies and information surrounding the market. This very fact is what makes the difference between successful forex traders and other traders.

A few additional points, which create such powerful leverage for investors within the forex market are: The amount of capital required to begin investing in the market is only three hundred dollars. For the most part, any other investment market is going to demand thousands of dollars of the investor in the beginning. Also, the market offers opportunities to profit regardless what the direction of the market may be; In most commonly known markets investors sit and wait for the market to begin an up trend before entering a trade. Even then, investors, as a rule must sit and wait some more to be able to exit the trade with a nice profit. Given that the forex market produces several up, down, and sideways trends in a single day, it can easily be seen that forex stands head and shoulders above other markets. Additionally there are trading strategies, which are taught that provide for compounded profits; these are profits on top of profits. In addition, free demo accounts are available within the industry of forex trading, which facilitate the sharpening of skills without the risk losing any capital. And the advantage regarding the time factor in trading foreign currency is a very attractive point for any investor. Compared to one of the most sought after avenues of investing, which often requires forty or more hours each week, namely in the real-estate market, the forex market requires a much smaller demand on the investor's time. Forex trading requires approximately ten to fifteen hours each week to earn a full time income. It's easy to see that the advantages and great leverage that exist in the forex market, make it among the most lucrative, time liberating, and easy to enter by far.

I hope this information gives you a clear understanding of how you can turn your investing into a true method of making your money work harder for you.

What are the advantages of the Forex Market over other types of investments?

When thinking about various investments, there is one investment vehicle that comes to mind. The Forex or Foreign Currency Market has many advantages over other types of investments. The Forex market is open 24 hrs a day, unlike the regular stock markets. Most investments require a substantial amount of capital before you can take advantage of an investment opportunity. To trade Forex, you only need a small amount of capital. Anyone can enter the market with as little as $300 USD to trade a "mini account", which allows you to trade lots of 10,000 units. One lot of 10,000 units of currency is equal to 1 contract. Each "pip" or move up or down in the currency pair is worth a $1 gain or loss, depending on which side of the market you are on. A standard account gives you control over 100,000 units of currency and a pip is worth $10.

The Forex market is also very liquid. When trading Forex you have full control of your capital.

Many other types of investments require holding your money up for long periods of time. This is a disadvantage because if you need to use the capital it can be difficult to access to it without taking a huge loss. Also, with a small amount of money, you can control

Forex traders can be profitable in bullish or bearish market conditions. Stock market traders need stock prices to rise in order to take a profit. Forex traders can make a profit during up trends and downtrends. Forex Trading can be risky, but with having the ability to have a good system to follow, good money management skills, and possessing self discipline, Forex trading can be a relatively low risk investment.

The Forex market can be traded anytime, anywhere. As long as you have access to a computer, you have the ability to trade the Forex market. An important thing to remember is before jumping into trading currencies, is it wise to practice with "paper money", or "fake money." Most brokers have demo accounts where you can download their trading station and practice real time with fake money. While this is no guarantee of your performance with real money, practicing can give you a huge advantage to become better prepared when you trade with your real, hard earned money. There are also many Forex courses on the internet, just be careful when choosing which ones to purchase.

The reports of the society making immeasurable gains in stocks markets have been delivered in newspapers around the world.So the first timer investors have been attracted to the stock market. Day trading is one of the organizations gaining in demand with investors. But this day trading has full of risks. However you can make immeasurable gains in day trading,you are also expected to expend huge money.On the other hand, if you want to do day trading the following tips and guidelines are here to make you succeed:

Who is day trader?

A person who actively associate within stock market and buys and sells frequently in a day to make quick income is called a day trader.

What are the following tips to succeed in day trading? Here are the 15 list of tips to guide you to succeed:

1. Study the fundamentals of the system like the functioning of the market, schedule to buy and sell, which way the stocks will be operate, and the long and short calls.You consider also learn to take care of the profits while cutting down the losses.

2. In view of excel in day trading is a time consuming process, apply the trading platform available on the trading websites before you actually start.

3. Avoid the thought of making losses let you to scare. Use strategies like stop orders to reduce your losses.

4. Do not worry, If you suffer some loss, as it is a portion of the process.

5. Stop trading, once you have earned your expected profit. Do not hunger after more money and throw away your profit.

6. Assuming that the market does not meet your expectations on each and every particular day, do not trade.

7. During the time that your experience in day trading increases, you gain the ability to foreknow the direction in which the stock price moves. But avoid to go for the lowermost or the topmost stocks.

8. If you find it crucial to decide in which way the market is going, do not trade but just paused and wait.

9. Keep up a record of the results of the day trading. It give permission you to learn the things which are effective, as well as ineffective.

10. Acquire some information about buying and selling tactics of successful day traders. These traders commonly sell when there is good news and buy when there is bad news.

11. Being aloof and professional is the main characteristics of being trader and don't be emotional.

12. Have confidence on your instincts as rely upon excessively on the analysis means skipping some good trading chances.

13. Be trained and use most important strategies to trade.

14. Concentrate and/or focus yourself only on a selected stocks. Sharpen your attention on various stocks will make it difficult for you to track the movement of each stock.

15. Educate yourself in a new trading strategies daily and use them to your benefit.

Forex is a potential platform for earning substantial profit. In fact it is one of the largest trading markets of the world. Featuring an average daily trade of US$ 2 trillion and above, this market is best known for its high scale trading volume and intense liquidity. Adding to this, today with the advancement of technology it can be done from anywhere of the world. Backed up by world-wide web, you can easily trade in the forex market at the comfort of your own home. However, it is important to understand that fx trading is based hugely on speculation. You must be smart enough to guess exactly when the rate of a certain currency pair will rise and go down, and then buy or sell based on that. Indeed it is said that if you learn to study the speculation of this market, you will have a better chance of getting profit.

Today, it is more advanced and turned into an active investment arena, where only a factual understanding of the intricacies and complexities can make your capital grow every day. Moreover, like any other business, it also involves some amount of risks. There is no shot fx trading technique for success in the currency trading market, but there are some well-known techniques that can assist you formulate a good advanced foreign exchange trading strategy. Here are few essential techniques that can help you cut your losses and increases profits:

Forex Scalping: It is a latest technique of trading where profits are taken after relatively small moves in the forex market. It is a technique where trading is done over small time frames, and smaller profits are taken more frequently. As the position exposed to the market is shorter, it automatically reduces the risk of adverse market events causing the price to go against the trade. It is a different approach to most other forex strategies, but still requires you to analyze the market to ensure that the set up for a trade is present. This type of trading greatly appeals to day traders and those who look to reduce the risk involved in trading currencies.

Forex Hedging: It is a technique that helps in reducing some of the risk involved in holding an open forex position. It decreases the risk by taking both sides of a trade at once. If your broker allows it, a simple way to hedge is just to initiate a long and a short position on the same pair. Advanced traders sometimes use two different pairs to make one hedge, but that can get very complicated.

It is important to understand that much of the risk involved in holding any forex position is market risk; i.e. if the market falls sharply, your losses may escalate dramatically. So if you have an open Forex position with fine projection but you think the currency pair may reverse against you, it is advised to hedge your position.

Forex Position Trading: Forex position trading approach is yet another trouble-free technique to boost your position size without increasing your risk. This trading tactic is very effective with mini lots. The major highlight with this technique is that - with forex position trading your exposure to the market is less and so therefore is no need to monitor the market continuously. Moreover, you may even earn profit with negligible loss that can further boost your trading confidence. For Example- you might make a short trade on EUR/USD at 1.40. If the pair is ultimately trending lower, but happens to retrace up, and you take another short at say 1.42, your average position would be 1.41. Once the EUR/USD drops back below 1.41, you will be back in overall profit.

Today forex trading is all about watching your options when you make a trade. Aside from using effective risk management and extreme vigilance, advanced trading can be an alternate way to make profits and control losses. Nevertheless, these above mentioned advanced trading techniques are more about using the market behavior to your advantage. Utilizing these advanced techniques can give you the edge from other average trader.

Did you ever consider making money in Forex trading as a home based business? I did and I was let down embarking, however, after doing some home effort, I was absolutely certain with this brainstorm. I consider my initial losses in Fx trading nothing but a startup expense that's linked with any venture you can think of. Not here forever all my sorrows.

One affair that I like about the Fx trading business is that you can rehearsal at no cost for as long as you desire, and one more feature is that you can pull together as much information about as you can perhaps cope with before you leap into this venture. Understanding, practice and some slight startup funds is all you need. If you do not cover the last, or the necessary capital to set up an account then all you have to do is study to be gainful in demo account and convert a wealthy comrade of yours to go in mutual undertaking with you, many are doing this. You supervise the account for your rich associate who's wealth is gathering nothing but dust someplace even in the bank account your friend's savings would barely make him 4% a year. if you develop into a profitable Currency trading trader you can make your friend this type of yield every solo business day instead of an entire year after you capture yours. A Currency trading account administrator is at liberty to have more than 30 % of all returns on original invested capital. You can gain knowledge of Forex trading by visiting unbiased websites that endow with loads of information regarding Currency trading all for free, you can get the ready established approach or wait until you develop yours.

One such set trading methods that you can go ahead and take hold of it to diminish the time required to turn out to be a thriving currency trader is the Forexbody procedure. This approach is so unfussy that anyone without even the slightest clue about Forex can be taught, first by browsing the valuable neutral information and watching the free Metatrader screen recordings on the forexbody website. Particular lexis about the Forexbody metatrader screen recordings, these measures are not for babypips guys and girls, these videos demonstrate remarkably very hard-hitting forex trading that can only be done by those who have become very good at the game well. Picture an account made twice larger in 30 minutes, yes screen recordings on Forexbody site illustrate just precisely this breed of exertion, but on the other hand, as tyro you get careful guidance on the site and recommendations on trading the easy mode to achievement.

The website has Currency trading signal by sms that you can evaluate for free. the signal has a victory rate of over 93% and if you are to be fulfilled with just the eminent 10 pip yield limit per deal the success rate would exceed 98 %. Even trades that turn out to be losers revolve to winners when given enough time. There a abundance of information on how to be thriving using Forexbody two times a day signal and there are 10 rules you have to abide by and according to Forexbody source, you can twofold your account every 45 days with low risk trading habits. all you need is self discipline and a robust will to tug the trigger immediately upon getting trading signal.

To be able to meet with ceaseless earnings you need to instigate the low risk approach, with this strategy a small account can be on track and full-grown over the period of 4 to 6 months to a decent amount where it can engender as much as $3000 in unbroken take-home pay, another time without taking piercing risks, while parting room for further expansion for further and unlimited upsurge in income.

The Wrapping up, If you ever thought about having your own business and working from the soothe of your own residence, you got to give this a test, It will not cost you any money to test the whole lot on virtual accounts that you can get free from plenty of Fx trading brokers worldwide, but you have possibility to be your own boss in a short time and the attempt on achieving the American ambition, stop commuting and fling that dress rules away.

Did you ever think about making money in Forex trading as a Business Opportunity? I did and I was let down in the beginning, however, after doing some home effort, I was utterly certain with this brainstorm. I consider my initial losses in Forex nothing but a startup cost that's coupled with any venture you can imagine. Gone forever all my regrets.

One detail that I like about the Fx trading business is that you can rehearsal at no cost for as long as you wish, and one more thing is that you can accumulate as much information regarding as you can possibly come to grips with before you leap into this undertaking. Understanding, preparation and some little startup money is all you need. If you do not hold the latter, or the vital funds to start an account then all you get to do is study to be advantageous in demo account and prove to a wealthy pal of yours to go in dual scheme with you, many are doing this. You control the account for your wealthy acquaintance who's capital is collecting nil but dust someplace even in the bank account your friend's stash would hardly formulate him 5 per cent a year. if you grow to be a victorious Currency trading trader you can brew your buddy this form of gain every solo business day instead of an whole year after you pocket yours. A Forex account director is entitled to more than 30 per cent of all proceeds on original invested funds.

You can be taught Forex trading by visiting unbiased resources that provide loads of information in relation to Currency trading all at no charge, you can get the ready demonstrated system or wait until you develop yours.

One such prepared systems that you can go ahead and grab it to relegate the time needed to grow to be a triumphant international currency trader is the Forexbody system. This technique is so effortless that anyone without even the slightest idea about Fx trading can learn, first by visiting the helpful unprejudiced information and watching the free videos on the forexbody website. Special lexis about the Forexbody videos, these measures are not for babypips boys and kids, these videos give you an idea about strikingly very hard-hitting forex trading that can only be done by those who have become very good at the game well. Picture an account equity increased twice the original size in 7 minutes, yes real videos on Forexbody website illustrate just exactly this sort of drudgery, but on the other hand over, as student you get cautious guidance on the site and instructions on trading the stress-free mode to achievement.

The website has Currency trading signal by sms that you can take a crack at for free. the signal has a success rate of over 94% and if you are to be contented with just the great 10 pip yield limit per trade the success rate would exceed 96 %. Even trades that turn out to be losers go round to winners when given time. There a large quantity of information on how to be thriving using Forexbody twice a day signal and there are 10 rules you have to bear by and according to Forexbody author, you can double your account every 45 days with low risk trading behavior. all you need is self discipline and a resilient will to tug the trigger instantly upon receiving trading signal.

To be able to sustain never-ending returns you need to put into practice the low risk methodology, with this tactic a small account can be on track and full-grown over the time of 4 to 6 months to a acceptable mass where it can engender as much as $3000 in steady earnings, once more without enchanting lofty risks, while leaving room for further increase for additional and unrestricted expansion in takings.

The Conclusion, If you ever thought about having your own business and working from the comfort of your own house, you got to give this a stab, It will not cost you any money to test all on implicit accounts that you can get free from hundreds of Forex brokers All over the world, but you have possibility to be your own boss in a short time and the attempt on achieving the American desire, stop commuting and throw that dress rules away.

Factors That Influence Forex Trading

The value of a country's currency is influenced by a number of factors: The economics of the country, its trade deficit, political and social environment.

If the current government's deficit increases, its currency's value will fall. As the government decreases its deficit, the currency can begin to recover value and the exchange rate will become more favorable. The same relationship holds true with a country's trade deficit. If the country imports more goods and services than it exports it will have a negative influence on the currency.

Inflation lessens the ability of a unit of currency to buy less and less, so the currency loses value. If the inflation becomes rampant the currency is valued less because it's also viewed as unstable. As the rate of inflation begins to decline the currency begins to increase in value.

Politics and social changes can play havoc with the currency exchange rates. Changes in the regime that are viewed negatively can lower the value of the country's currency in the short term and continue into the long term. If the present government makes decisions that are looked at negatively it can decrease the currency value as well. The opposite can happen. Current government officials can make policy changes that are viewed positively by the rest of the world and that can increase the value of the currency.

For the United States, interest rates and the price of oil can have a major impact on the value of the US dollar.

Interest rates effect how much it's going to cost to borrow money and how much can be earned on investments. Historically if the US raises its interest rates it attracts foreign investors. Those investors have to sell their own currency in order to buy U.S. dollars to purchase treasury bonds. If the interest begins to drop, or the perception is that the rates won't rise any more, investors may purchase Euros as an alternative investment which lowers the value of the US dollar.

The United States is dependent on foreign oil production. Many US industries are dependent on oil and an increase in the price of oil means an increase in their expenses and a drop in profits. In a similar way, a country's dependency on oil influences how the country's currency is valued and will be impacted by changes in oil prices. The US's dependency on oil makes the dollar more sensitive to oil prices than countries who aren't so dependent. As the price of oil increases the value of the dollar drops.

3 Rules to Make serious earnings

If you want to catch the serious profit in forex dealing you need to trend watch forex trends which are worse term. here we are going to give you a 3 step simple method which if you use it correctly, will help you catch every superior forex trend and lead you to long-term term currency dealing success.

Most beginner traders don't bother trying to trend following forex lengthier term - instead they try forex scalping or day trading. These methods focus the trader on small moves and they hope to catch small profit however as most short term moves are random, this leads to equity eliminate.

The other alternatives are swing trading and long term forex trend following and this article is all about the latter method. If you look at any forex chart, you will see long-term term trends that last for months or years. These moves can and do yield serious profit - present we will outline a simple method to get them.

Breakouts

By far the best way of catching the serious moves is to use a forex dealing strategy based around breakouts. A breakout is simply a move on a forex chart where a new high or low is made and resistance or support is broken.

It's a fact that most leading moves start from new highs or lows.

While it might appear that you are not buying or selling at the greatest level, you are in terms of the odds of the trend continuing. Most forex traders make the mistake of waiting for the breakout to come back and get in at a better price but these traders never get on board. The grounds for this is if a breakout occurs, then you have a new strong trend and a pullback is not very likely to occur.

Most traders don't buy or sell breakouts and that's exactly why it's such a powerful method.

The only point to keep in mind is a support or resistance which is ruined, should be valid and that means at least 3 points in at least 2 different times frames. The more tests and the greater the spacing between the tests the more valid the level is.

Confirmation

Of course not every breakout keeps and some reverse, these are false and can cause losses. You therefore need to confirm each move. All you need to do to achieve this is to put a few momentum indicators in your forex trading system to confirm your dealing signal.

These indicators give you an estimation of the strength and velocity of price and there are many to choose from. We don't have time to discuss them here (simply look up our other articles) but two of the greatest are - the stochastic and Relative Strength Index RSI

Stops and Targets

Stop points are easy with breakouts - Simply behind the breakout point.

If you have a serious trend then you need to be careful you can milk it, so don't move your stop to soon and keep it outside of normal volatility. If it is a huge move, trailing stops should be held a long-term way back and the 40 day moving average is a good level to use.

You have to keep in mind that when the trend does eventually turn you are going to give some profit back. You don't know when the trend is going to end, so don't predict.

It's ok to give a serious back, as that's the nature of trading forex. Keep in mind if you got 50% of all leading trend you would be very rich. When you are long-term term trend following you have accept giving a bit back and taking dips in open equity as the trend develops - this is noise and does not affect the long term trend.

The above is a simple way to trend watch forex and catch the high odds moves that yield the serious profit. If you are learning forex dealing and want a simple method that is robust and will help you get every major move, then you should base your dealing on the above method.

Courage Under Stressful Conditions When the Outcome is Uncertain

All the foreign exchange trading knowledge in the world is not going to help, unless you have the nerve to buy and sell currencies and put your money at risk. As with the lottery “You gotta be in it to win it”. Trust me when I say that the simple task of hitting the buy or sell key is extremely difficult to do when your own real money is put at risk.

You will feel anxiety, even fear. Here lies the moment of truth. Do you have the courage to be afraid and act anyway? When a fireman runs into a burning building I assume he is afraid but he does it anyway and achieves the desired result. Unless you can overcome or accept your fear and do it anyway, you will not be a successful trader.

However, once you learn to control your fear, it gets easier and easier and in time there is no fear. The opposite reaction can become an issue – you’re overconfident and not focused enough on the risk you're taking.

Both the inability to initiate a trade, or close a losing trade can create serious psychological issues for a trader going forward. By calling attention to these potential stumbling blocks beforehand, you can properly prepare prior to your first real trade and develop good trading habits from day one.

Start by analyzing yourself. Are you the type of person that can control their emotions and flawlessly execute trades, oftentimes under extremely stressful conditions? Are you the type of person who’s overconfident and prone to take more risk than they should? Before your first real trade you need to look inside yourself and get the answers. We can correct any deficiencies before they result in paralysis (not pulling the trigger) or a huge loss (overconfidence). A huge loss can prematurely end your trading career, or prolong your success until you can raise additional capital.

The difficulty doesn’t end with “pulling the trigger”. In fact what comes next is equally or perhaps more difficult. Once you are in the trade the next hurdle is staying in the trade. When trading foreign exchange you exit the trade as soon as possible after entry when it is not working. Most people who have been successful in non-trading ventures find this concept difficult to implement.

For example, real estate tycoons make their fortune riding out the bad times and selling during the boom periods. The problem with trying to adapt a 'hold on until it comes back' strategy in foreign exchange is that most of the time the currencies are in long-term persistent, directional trends and your equity will be wiped out before the currency comes back.

The other side of the coin is staying in a trade that is working. The most common pitfall is closing out a winning position without a valid reason. Once again, fear is the culprit. Your subconscious demons will be scaring you non-stop with questions like “what if news comes out and you wind up with a loss”. The reality is if news comes out in a currency that is going up, the news has a higher probability of being positive than negative (more on why that is so in a later article).

So your fear is just a baseless annoyance. Don’t try and fight the fear. Accept it. Have a laugh about it and then move on to the task at hand, which is determining an exit strategy based on actual price movement. As Garth says in Waynesworld “Live in the now man”. Worrying about what could be is irrational. Studying your chart and determining an objective exit point is reality based and rational.

Another common pitfall is closing a winning position because you are bored with it; its not moving. In Football, after a star running back breaks free for a 50-yard gain, he comes out of the game temporarily for a breather. When he reenters the game he is a serious threat to gain more yards – this is indisputable. So when your position takes a breather after a winning move, the next likely event is further gains – so why close it?

If you can be courageous under fire and strategically patient, foreign exchange trading may be for you. If you’re a natural gunslinger and reckless you will need to tone your act down a notch or two and we can help you make the necessary adjustments. If putting your money at risk makes you a nervous wreck its because you lack the knowledge base to be confident in your decision making.

Patience to Gain Knowledge through Study and Focus

Many new traders believe all you need to profitably trade foreign currencies are charts, technical indicators and a small bankroll. Most of them blow up (lose all their money) within a few weeks or months; some are initially successful and it takes as long as a year before they blow up. A tiny minority with good money management skills, patience, and a market niche go on to be successful traders. Armed with charts, technical indicators, and a small bankroll, the chance of succeeding is probably 500 to 1.

To increase your chances of success to near certainty requires knowledge; acquiring knowledge takes hard work, study, dedication and focus. Compile your knowledge base without taking any shortcuts, thereby assuring a solid foundation to build upon.

The Forex market is often more appealing to people that like to live on the edge. The

Forex market is often more appealing to people that like to live on the edge.

There is more uncertainty by far and the rewards of knowing when to buy and sell

can be immense.

For those of you who do not know, the Forex

stands for, Foreign Exchange Market. The Forex deals in all different types of

currencies and pits them all against each other. For example: the English pound

might be worth more than the American dollar but if there is a natural disaster

or a nasty political event, then the pound could drop below the value of the

American dollar and thus would make money for the individual who had bought the

English pound, when they sell.

The people who trade on the

Forex market are known as day traders. The reason for this is that the day

trader buys at the beginning of the market for that day and then sells off all

that he or she had bought by the end of the day. This type of trading is not for

the inexperienced. There is potential to make a lot of money on the Forex

market, but it takes a person knowledgeable in all the different facets of this

slippery exchange to make money. A neophyte to this market can easily be wiped

out in a matter of minutes!

The Forex market is also a liquid

market with currencies exchanging hands moment to moment. Since transactions are

handled electronically around the world, it only takes moments for funds to

transfer to different accounts. It is easy to make some trades, watching news

events in the country of the currency bought, and then sell it all, in order

have money in your bank account by dinner time.

The Forex

market is also open twenty-four hours a day since it encompasses the larger

markets all over the world. Theoretically, a trader can work all day and all

night. This makes the foreign exchange market very popular since people can

trade any time they wish. A person can be trading on the Paris exchange until

they close at which time the New York exchange is just opening up for the day.

There are five major foreign exchange market around the world. They are New

York, London, Frankfurt, Paris, Tokyo, and Zurich.

Many

people like to invest in the Forex market since there is a lot of leverage

available to the day trader. For instance, five thousand dollars can be

leveraged to purchase five hundred thousand dollars through margins. What this

means is that individual investors can trade with much more money than they

actually have. However, one must be careful; it is quite easy to lose the money

and thus has to pay much more than is actually in the bank account.

The Forex market is a challenging market to understand and can be

hazardous to those not experienced in day trading. Nevertheless, for those who

are experienced and can see the patterns of the market, it can be thrilling and

extremely lucrative.ere is more uncertainty by far and the rewards of knowing

when to buy and sell can be immense.

For those of you who don

not know, the Forex stands for, Foreign Exchange Market. The Forex deals in all

different types of currencies and pits them all against each other. For example:

the English pound might be worth more than the American dollar but if there is a

natural disaster or a nasty political event, then the pound could drop below the

value of the American dollar and thus would make money for the individual who

had bought the English pound, when they sell.

The people who

trade on the Forex market are known as day traders. The reason for this is that

the day trader buys at the beginning of the market for that day and then sells

off all that he or she had bought by the end of the day. This type of trading is

not for the inexperienced. There is potential to make a lot of money on the

Forex market, but it takes a person knowledgeable in all the different facets of

this slippery exchange to make money. A neophyte to this market can easily be

wiped out in a matter of minutes!

The Forex market is also a

liquid market with currencies exchanging hands moment to moment. Since

transactions are handled electronically around the world, it only takes moments

for funds to transfer to different accounts. It is easy to make some trades,

watching news events in the country of the currency bought, and then sell it

all, in order have money in your bank account by dinner time.

The Forex market is also open twenty-four hours a day since it encompasses the

larger markets all over the world. Theoretically, a trader can work all day and

all night. This makes the foreign exchange market very popular since people can

trade any time they wish. A person can be trading on the Paris exchange until

they close at which time the New York exchange is just opening up for the day.

There are five major foreign exchange market around the world. They are New

York, London, Frankfurt, Paris, Tokyo, and Zurich.

Many

people like to invest in the Forex market since there is a lot of leverage

available to the day trader. For instance, five thousand dollars can be

leveraged to purchase five hundred thousand dollars through margins. What this

means is that individual investors can trade with much more money than they

actually have. However, one must be careful; it is quite easy to lose the money

and thus has to pay much more than is actually in the bank account.

The Forex market is a challenging market to understand and can be

hazardous to those not experienced in day trading. Nevertheless, for those who

are experienced and can see the patterns of the market, it can be thrilling and

extremely lucrative.

Do you know that a good forex trading system can turn into

a losing system if you do not have good money management? On the contrary, a

good money management rule can turn an average trading strategy into a winning

one. Let's look at some forex tips on how to double or even triple your gains

when making money online.

1. Reduce trading frequency and

don't overtrade

Many novice traders just got too impatient to

wait for quality trades. Therefore, they trade too much and the worst is they

take any kind of low probability trades. I have mentioned that forex trading is

all about probabilities no matter what kind of forex strategy you use.

Though I also said that good trading opportunities will come easily,

you must still observe the rule of taking only quality rather than quantity

forex trades. There are traders who only trade 3 or 4 times a month and it is

already enough for them to make a living in the forex market.

2. Diversify your forex trades

Diversification does not only

have to apply to stocks, you can use it in forex trading too. If you have a

small account and you think that you will only need to concentrate on one

currency pair e.g. EUR/USD to make a living as a forex trader, then you are

missing out something.

To become successful in trading and

become a full time trader, you will need to trade more than one currency pair

because while one pair does not gives you forex signals, the other pairs may

have trading opportunities.

3. Forex money management is

about calculated risk and probability.

The fact that many

traders try to avoid risk in forex trading is totally wrong! How can there be no

risk in the forex market? The solution should be how you are going to handle

risk and not how to avoid it. Some forex trading tips here is that you should

have a good risk to reward ratio as a money management rule.

Imagine that you risk 200 pips just to get the 20 pips profits, then you will

have to get 10 trades right to breakeven if you have lost one! This is not the

correct way of trading. Instead, if you risk 30 pips, then target 60 pips or

more as profits, so that one winning trade is already enough to cover if you

have 2 lost trades. And good risk to reward can lead you to achieve triple times

your forex profits!

The majority of Forex Trading Systems that are used by beginner traders are focused towards short term trading strategies, which aim to take small risk and promise to pile up massive profits and regular income.So we will look at how to succeed.The major challenges that Forex day trader face are the following:There are millions and millions of individuals will all different views, skills, knowledge, who think very differently so what Forex Trading System can predict reliably what will happen in the next minute, next hour or next day?Lets be honest not one of them can reliably predict this.From experience this is simply the silliest way to be trading forex, with all of the differences and variables it is impossible to know what is going to happen in the coming minutes, hours, days, and here is why.Fact: All volatility in short term time frames is random and you cannot get the odds on your side, you can't win long term it is as simple as that!Most of the forex day trading strategies, systems that have ever been purchased have ever made any really gains, sometimes random luck will see people profit. Most of them show back tests of the past, this is easy to show positive as you already know the outcome and can adjust the test accordingly.Most of the systems are just incredibly brilliant sales pitches that work on peoples greed, and create a good story like Mary Poppins.All is not lost you can win Best Forex Broker, but it is not as simple as turning on computer and putting in a program, it does take some skill and knowledge. You need to get the odds stacked in your favor and one strategy to be able to do this is through swing trading or long term trend following. Remember trend is your friend, so if you follow your system it can mean big profits if you have a great forex system and have the knowledge to be able to do it.Do not make the mistake of day trading or forex scalping, get the right Forex education and trade long term and you can soon be enjoying currency trading success to get more Free Education feel free to visit the CFD FX REPORT they can provide you with valuable education lessons and help you find the Best Forex Broker in the Market.

Happy Trading The majority of Forex Trading Systems that are used by beginner traders are focused towards short term trading strategies, which aim to take small risk and promise to pile up massive profits and regular income. So we will look at how to succeed.The major challenges that Forex day trader face are the following:There are millions and millions of individuals will all different views, skills, knowledge, who think very differently so what Forex Trading System can predict reliably what will happen in the next minute, next hour or next day?Lets be honest not one of them can reliably predict this.From experience this is simply the silliest way to be trading forex, with all of the differences and variables it is impossible to know what is going to happen in the coming minutes, hours, days, and here is why.Fact: All volatility in short term time frames is random and you cannot get the odds on your side, you can't win long term it is as simple as that!Most of the forex day trading strategies, systems that have ever been purchased have ever made any really gains, sometimes random luck will see people profit. Most of them show back tests of the past, this is easy to show positive as you already know the outcome and can adjust the test accordingly.Most of the systems are just incredibly brilliant sales pitches that work on peoples greed, and create a good story like Mary Poppins.All is not lost you can win Best Forex Broker, but it is not as simple as turning on computer and putting in a program, it does take some skill and knowledge. You need to get the odds stacked in your favor and one strategy to be able to do this is through swing trading or long term trend following. Remember trend is your friend, so if you follow your system it can mean big profits if you have a great forex system and have the knowledge to be able to do it.Do not make the mistake of day trading or forex scalping, get the right Forex education and trade long term and you can soon be enjoying currency trading success to get more Free Education feel free to visit the CFD FX REPORT they can provide you with valuable education lessons and help you find the Best Forex Broker in the Market.Happy Trading

Investing in foreign currencies is a relatively new avenue of investing. There are considerably fewer people are aware of this market than there are people aware of several other avenues of investing. Trading foreign currency, also known as forex, is the most lucrative investment market that exists. There are several factors that make this true among which, successful forex traders earn realistic profits of one hundred plus percent each month. Compared to some of the better known investment markets such as corporate stocks, this is an unheard of return on investment. It's very necessary to mention here that a person who invests in forex must, without exception, make it a point to learn the detailed, but simple strategies and information surrounding the market. This very fact is what makes the difference between successful forex traders and other traders.

A few additional points, which create such powerful leverage for investors within the forex market are: The amount of capital required to begin investing in the market is only three hundred dollars. For the most part, any other investment market is going to demand thousands of dollars of the investor in the beginning. Also, the market offers opportunities to profit regardless what the direction of the market may be; In most commonly known markets investors sit and wait for the market to begin an up trend before entering a trade. Even then, investors, as a rule must sit and wait some more to be able to exit the trade with a nice profit. Given that the forex market produces several up, down, and sideways trends in a single day, it can easily be seen that forex stands head and shoulders above other markets. Additionally there are trading strategies, which are taught that provide for compounded profits; these are profits on top of profits. In addition, free demo accounts are available within the industry of forex trading, which facilitate the sharpening of skills without the risk losing any capital. And the advantage regarding the time factor in trading foreign currency is a very attractive point for any investor. Compared to one of the most sought after avenues of investing, which often requires forty or more hours each week, namely in the real-estate market, the forex market requires a much smaller demand on the investor's time. Forex trading requires approximately ten to fifteen hours each week to earn a full time income. It's easy to see that the advantages and great leverage that exist in the forex market, make it among the most lucrative, time liberating, and easy to enter by far.

I hope this information gives you a clear understanding of how you can turn your investing into a true method of making your money work harder for you.

When the going gets tough, the tough get going. This adage often brings back the memories of my past days when I was trading initially in the currency exchange market. Indeed, there's nothing more hurtful than losing your invested money in the FX market. But, online currency trading is like life where you're got to learn from your wrong moves and keep moving on. Learning the basic skills of online forex trading could be easy but, practically, one needs to acquire the advanced skills to play safe through thick and thin of FX trading.

I have traded in forex for many years and, if you count on me, I must tell you that the secret of successful trading lies largely on the hunch and intuition of an trader. Technically expressed, you should have the accurate forex alerts and forex signals to be able to make the right moves in the currency market. However, this is easier said than done as the skills of the Currency Trading Signal takes a long time to master. This is why while a few people are able to boost their forex pips in a short span of time, the others take a long time to achieve the same or maybe, some of them get frustrated and just give it up! The reality is that not many people are ready to be entirely devoted to the perilous process of online forex trading.

Having said this, I still wonder why some people choose to be a dare-devil and risk their money instead of simply following an established and renowned Account Forex Online Trading. I began trading in 1997 and there is one important thing I have learnt in my trading career so far, i.e., you have to got to be patient to learn the tricks of making right moves at the right times and profit from your trading.

Since I have led quite a successful career in forex trading, I have been sharing the tips and tricks of online currency trading with many traders around the world through my G7 Forex Trading System which as you know has remained pretty successful for many traders so far. My G7 Forex Trading System is an easy-to-follow, step-by-step trading manual offering in-depth online forex trading review.

If you visit my site (www.forex-science.com) you will find many of my existing customers are pretty satisfied with the performance of their investments and in fact, most of them have been able to increase their forex pips drastically. You would be surprised to know quite a few of them haven't traded for a long time! Now, this is what we call success in the forex trading, eh?

George Lane developed this indicator in the late 1950s. Stochastics measure the current close relative to the range (high/low) over a set of periods.

Stochastics consist of two lines:

%K - Is the main line and is usually displayed as a solid line

%D - Is simply a moving average of the %K and is usually displayed as a dotted line

There are three types of Stochastics: Full, fast and slow stochastics. Slow stochastics are simply a smother version of the fast stochastics, and full stochastics are even a smother version of the slow stochastics.

Interpretation:

Sell when %K rises above de overbought level (above 80) and falls back below the same level.

The interpretation above is how most traders and investors use them; however, it only works when the market is trendless or ranging. When the market is trending, a reading above the overbought territory isn't necessary a bearish signal, while a reading below de oversold territory isn't necessary bullish signal.

Trending market

Thus when the market is trending up, we will only look for oversold conditions (when the stochastics fall below the oversold level [below 20] and rises back above the same level) to get ready to trade, and in the same way, when the market is trending down we will only look for overbought conditions (when the stochastics rise above de overbought level [above 80] and falls back below the same level.

Trend-less market

Divergence

Stochastics can also be used to trade off divergences.

Price behavior

I hope this article helps you become a better trader.

Don't forget to read our risk disclaimer.

Forex.pk, Pakistan's best forex portal provides you upto the minute forex rates in Pakistan Open Market, Pakistan Inter Bank & International forex market. Here you will find forex rates archives, graphs, charts, forex news, forex dealers directory, currency directory, gold prices, pakistan prize bond results and a wide range of information to help you explore the world of forex.

The Russian currency gained most in almost a decade as the crude oil reached $64 a barrel and metallic commodities are on the rise, creating speculations that Russia, a world leader in commodity exportation, will benefit from a global economic rebound.

Top Forex news From all Over the World

Russian Ruble Rises as Oil Hits Six-Month High:

The Russian Stock Market posted a week of gains as the price of oil is rose,Pushed by rising demand in Asia.

Dollar Slides Against Euro Before U.S. Job Reports:

The dollar has posted its third week of losses against the euro, mainly due improved world financial conditions, shrinking demand for refuge currencies.

Euro Rises Slightly After ECB Interest Rate Cut:

The Euro has a slight aginst the dollar after the European Central bank cut is bechmark interest rate to 1 percent, arecord low for European economic bloc.

USD/JPY Daily Commentary for 5.4.09

The USD/JPY is trying to build on Friday’s bounce, flirting with the idea of retesting 100 while the S&P futures battle their own demons at 900. Unfortunately, yesterday’s run was backed by light volume, meaning the currency pair’s current upswing could be short-lived. The USD/JPY encounters its first test in our 3rd tier downtrend line, followed by March highs. We notice a head and shoulders formation with the USD/JPY on its right shoulder as we type. Therefore, bulls will be looking for any near-term upward movement to be supported by heavy volume if the currency pair is ready to surpass 100 and April highs.

While the upside has its apparent hurdles, the downside is backed by our 2nd tier uptrend line and the resilience the uptrend has shown thus far in 2009. The USD/JPY’s re-approach of 100 comes with the S&P futures attempting to climb above their critical 900 level. Therefore, the significance of the moment is relayed by each as investors await Thursday’s ECB meeting and the release of America’s stress test results.

Fundamentally, we find resistances of 99.79, 100.56, 101.43, 102.14, and 103.15. To the downside, we see supports of 99.20, 98.56, 97.98, 97.11, and 96.33. The 100 level serves as a key psychological barrier with 95 acting as a psychological cushion. The USD/JPY is currently exchanging at 99.42.

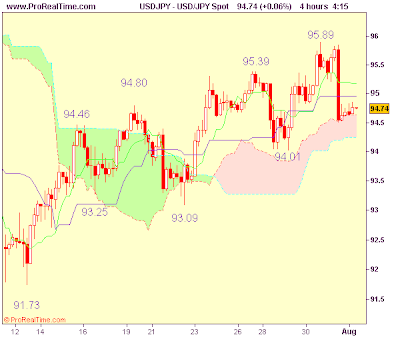

Trade Idea: USD/JPY - Sell At 95.50

Despite rising to 95.90 last week, the subsequent sharp retreat from there on Friday suggests a top has been formed there and correction to 94.01 support is likely, however, the greenback should find renewed buying interest above 93.81 (50% Fibonacci retracement of 91.73 to 95.89) and bring a rebound later but said resistance should continue to hold and bring another decline.

In view of this, we are still trading both sides of the market, buy on further fall towards 94.01 or sell on recovery to 95.40. Only a clear break of 96.15/20 (the confluence of 100% projection of 91.73 to 94.80 measuring from 93.09 and 61.8% Fibonacci retracement of 101.45 to 91.73 at 96.16) would extend recent upmove to 96.60/70. Below 93.81 would indicate the rise from 91.73 is over, then decline towards 93.09 support would follow.

Trade Idea: GBP/USD - Buy At 1.6665

Recent upmove gathered momentum after breaking 1.6587 resistance last Friday and the British pound rose to as high as 1.6780 this morning before easing. Friday’s rally caused the Tenkan-Sen to cross above the Kijun-Sen, providing a buy signal and although pullback to 1.6665/70 cannot be ruled out, the Tenkan-Sen (now at 1.6626) should hold and bring another upmove later towards 1.6830/40 but price should falter well below 1.6915 (100% projection of 1.5983-1.6587 measuring from 1.6338)

In view of this, we are still looking to buy cable on pullback and only a clear break below 1.6627 (50% Fibonacci retracement of 1.6474 to 1.6780) would defer this bullishness and risk correction towards the Kijun-Sen (now at 1.6559) which is likely to hold from here.

BSE Picks Up 15% in United Stock Exchange

The Bombay Stock Exchange (BSE) has revealed that it has purchased 15% stake in the United Stock Exchange (USE), a new entrant in the currency derivatives space.

The sources said that the company, which is having a paid up capital of Rs 150 crore, will now function as a BSE group company. BSE's investment will be Rs 22.5 crore, a 15% of the paid-up capital.

The sources further added that HDFC, Bank of Baroda, Federal bank, Union Bank of India, Allahabad Bank and Bank of India are existing shareholders of USE.

Until Dollar Traders Take in the NFPs, the RBA, ECB and BoE will Guide the Market

Until Dollar Traders Take in the NFPs, the RBA, ECB and BoE will Guide the Market

There is a lot of data scheduled over the coming week; and much of it holds the kind of market moving impact that could trigger breakouts. This is fortunate for those that love volatility; because many of the majors are resting on major anti-dollar support levels. All these individual releases aside though, the dollar will be put on the spot light immediately upon the open of Monday’s session in the Far East.The benchmark currency ended Friday with its lowest close since September 30th. Traders will demand either a retracement or breakout to relieve tension; but it is very likely that this may be based upon pure speculation or risk appetite. This means the US Non-Farm Payrolls report will not lead the symbolic breakout or reversal; but it will likely still have a considerable impact. Ensuring the dollar isn’t the only fundamental mover for the week, we will see two general themes from the calendar. In addition to US payrolls, there are employment change numbers scheduled for Canada, Australia and New Zealand. The other commonality will be rate decision. The RBA, BoE and ECB are all due to deliberate rates and offer statements; and each holds a significant sway over its regional currency..

• RBA Rate Decision – Aug 4th (04:30 GMT)

The Reserve Bank of Australia’s rate decision is the first of the three policy announcements due over the coming week. Of the 19 economists polled by Bloomberg, all believe Governor Steven’s board will keep the benchmark unchanged at 3.00 percent. There is further little disagreement from the market as overnight index swaps are pricing in a negligible probability of any change. Considering previous central bank activity, this seems the likely outcome; but there is always room for surprise – and a hike or cut would be a major catalyst. However, the real influence from this event will likely come from the commentary that follows the announcement. Speculators are ready to believe the central bank is done easing and the next move will be a hike. Confirmation of these predictions (and more prominently, a time frame said hike) would go a long way in for Aussie strength.

• Bank of England Rate Decision – Aug 6th (11:00 GMT)

There is almost no possibility of either a hike or cut from the Monetary Policy Committee next Thursday. Further cuts are naturally limited by the fact that the benchmark is already at 0.50 percent and further easing would essentially usher in a ‘zero interest rate policy.’ And, more to the point, an additional 25-50 basis points of easing would impart little, additional support to the economy. Instead, rate watchers will be looking for any changes to the central bank’s bond purchasing scheme. At the last meeting, the program was kept at 125 billion pounds, suggesting to some that they were not doing enough to revive the economy while others took it as a sign that they were taking the first step towards hikes. The latter prediction is a very long ways off; but the speculation stands. Prime Minister Brown authorized 150 billion; so there is an easy an easy buffer for expansion without sparking fear that the central bank is losing control of the situation. Alternatively, holding steadfast without the proper commentary may strike the market as foolhardy.

• European Central Bank Rate Decision – Aug 6 (11:45 GMT)

Though it does not carry the rates of its Australian and New Zealand counterparts, the euro is backed by one of the highest interest rates among the majors. What’s more, speculation of near-term hikes has gained more traction with the ECB than with nearly every other central bank in this echelon. However, from a fundamental perspective; it would be very ambitious indeed if there was a move to hikes within the next few months. The Euro Zone’s largest economies (Germany and France) seem to be stabilizing; but many of its other members are still mired in recession. Without consumer spending to truly catalyze expansion, banks expected to deliver write downs over the coming year and Eastern Europe threatening to spark a wave of defaults that could swamp the broader credit market once again; there is a good argument for retaining a ‘wait-and-see’ approach.

• Canadian Employment Change (JUL) –Aug 7 (11:00 GMT)

Over the past two months, the Canadian employment data has had a significant, absolute impact on the loonie. However, there are factors working against this release. The first issue to take account of is that it is released on a Friday. There are only a few hours of deep liquidity left before the market thins out for the weekend. This means a fundamental surprise needs to be significant enough to overcome the market’s summation that it is unlikely that a meaningful trend will be born from this individual release. What’s more, with the US labor statistics due out just an hour and a half later, the market often overlooks this indicator (especially for USDCAD) to see how healthy US consumer demand will be for Canadian exports. Nonetheless, this employment data will be vital for benchmarking Canada’s recovery; so expect a short-term and long-term impact.

• US Non-Farm Payrolls (NFPS) (JUL) – Aug 12:30 (12:30 GMT)

While different indicators and events go in and out of fad as the markets change; the US payrolls report seems to consistently hold near the top of the market-movers list. The July release will be no different. Looking ahead to the week, the dollar is on the verge of a new trend; but it would be a long wait to hold out until Friday before direction can be found. The technical landscape will likely be very different by the time this event is released; but the impact will still be the same. This is a leading growth indicator; but it doesn’t have the same influence as say the 2Q GDP release in providing scope for how the US will further influence the global economy. This means, barring a major surprise (a reading 200,000 or greater above or below the consensus), this is likely to have a straightforward impact on price action. The consensus calls for a 345,000-person cut in payrolls for the month of July. This would be the smallest drop in 10 months and further expectations of stabilization and the fabled recovery. However, the devil is in the details; and an unemployment rate near 10 percent doesn’t point to growth.

G20 Summit and U.S. Consumer Sentiment Set To Dominate USD Trading

Today's upcoming G20 Summit of the 20 most industrialized nations in Berlin, Germany today is set to dominate USD trading. Additionally, the forex market is set to go very volatile on the publication on the U.S. Import Prices indicator at 12:30 GMT, and the publication of the U.S. Consumer Sentiment indicator at 13:55 GMT. Forex traders are advised to open their Dollar positions now in order to make profits as today's events unravel.USD - Dollar Drops despite Positive Data from U.S

The Dollar's downtrend continued yesterday as the USD dropped against all the major currencies. The Dollar's most distinct bearish trend was marked against the GBP, as the pair was traded as high as the 1.6620 level.

In accordance to what appears to be developing into a pattern, the USD dropped in spite of some positive figures published from the US economy yesterday. The weekly Unemployment Claims report, which measures the number of individuals who filed for unemployment insurance for the first time during the past week, dropped for the fourth time in a row, this time to 601K. The figure is still quite large, and is far from depicting a strong, recuperating economy. However, the trend surely seems to favor the U.S. economy.

The U.S. Retail Sales figures were also published on Thursday, showing a 0.5% increase in the total value of sales at the retail level. This figure reflect a state of mind in which US consumers feel more comfortable to spend, which means they have more confidence that their financial status will improve with time. This kind of behavior is imperative in order to pull the economy out of recession, as only a better cycling of funds has the ability to create a real change in the current gloomy economic conditions.

As for today, there is the G20 Summit in Berlin Germany. Additionally, a batch of data is expected from the US economy, and traders are advised to focus on two main reports. First, the Import Prices which is scheduled for 12:30 GMT. This is one of the earliest publications that try to predict the level of inflation. Traders should also follow the Consumer Sentiment report, as analysts forecast another positive figure for this indicator, which can further support the notion that the U.S. economy returns to the fast lane.

EUR - EUR Looks to Finish the Week Strong

EUR trading on Thursday was highlighted by the EUR/USD climbing back above the 1.4100 level. In a week that was showing bearish movement on the oft-traded pair, the Euro rallied to make up ground on last weeks closing, as it trumped both the greenback and the Yen. Yesterday's push came shortly after the release of US economic data. Positive change in US Retails Sales and Unemployment Claims did not impress enough to drop the EUR for the USD, as the pair went bullish, as traders bought back into higher-yielding assets.

Early Thursday morning, saw the release of the European Central Bank's (ECB) Monthly Bulletin, which reveals data gathered by the ECB Governing Board on the state of the Euro-Zone economy. The report helped get the ball rolling on a bullish EUR trading day.

Traders can look toward Industrial Production at 9:00 GMT and a speech by ECB President Jean-Claude Trichet at 11:30 & 15:30 GMT for some indication to how the rest of the day will go for the EUR. Traders should also follow news from the opening of the G20 Meeting in Berlin, Germany throughout the day for any clues on policy that could add volatility to the forex market.

JPY - JPY Moves on Market Volatility

The Yen's high volatility continued yesterday, as it saw contradicting trends against the major currencies. On one hand, the JPY rose 15 pips against the USD yesterday, as the pair closed at the 97.75 level. On the other hand, the Yen dropped over 50 pips against the EUR, closing at 137.86 level.

It appears that lately the Yen is mostly affected by its counterpart currencies. The USD is currently very weak, and thus the Yen consistently appreciates against it. However, the EUR seems quite strong, and its recent appreciation has pushed down the JPY.

Looking ahead to today, traders are expected to follow the main news events from the US and Western Europe, and the commencement of the G20 Meeting in Germany later today. Traders are advised to follow these events very closely as they may set the pace for JPY trading later today.

Crude Oil - Oil Eyes $75 a Barrel

Crude Oil's bullish trend continues as the price of Crude continues to rise. Oil rose 42 cents to finish trading at $72.39 yesterday. The main reason for Crude's bullishness was the positive economic data released from the US economy. The weak Dollar also helped push up Oil prices yesterday. In addition, the International Energy Agency corrected its demand projection and increased it to 120,000 more barrels a day.

The bullish trend of Crude Oil looks to continue, with the potential of reaching $75 a barrel. Traders should follow the data published from the US, and news coming out of the G20 Meeting later today, as these factors are set to play into Crude Oil's bullishness later today.

Forex 4-Pack

Forex 4-Pack - Bill Poulos spent the last few weeks making updates to what is probably his most popular Forex training material - the “Forex 4-Pack”.

This report is now 100 pages and it has more actionable Forex tactics than many courses you have to PAY FOR. A lot of folks ask me why he gives away so much high-value Forex material. After all, he could be charging for this.

The reason he does this is simple: He wants to prove to you that trading Forex doesn’t have to complicated, and he also wants to give you a chance to experience his style of teaching.

Most of you may know or have heard of Bill Poulos, a thirty+ year ‘veteran’ of the financial markets. Bill Poulos has been trading the markets since 1974. What separates Bill Poulos from other ‘to-be gurus’ is that he began as a trader and has learned the hard lessons himself and developed the discipline that’s necessary to be profitable on a sustained basis.

In his over 30 years of trading experience, Bill has developed dozens of trading systems and methods. Bill Poulos is the creator of Instant Profits, the Quantum Swing Trader, and most recently the Forex Profit Accelerator. His products come highly recommended and his systems are based on a solid understanding of the market.

He prides himself on providing honest and realistic trading education, and is known for the continuous and ongoing support and follow-up he offers his students. So I am sure that Bill will have no objections if I share this information with you. Here’s the link to: Stop Day Trading Forex - Spend Less Time, Get More Pips.

Interested? All the details are here: Forex 4-Pack

11: Methods of Foreign Exchange Trading For Starters

12: Knowing the Foreign Exchange Trading Basics

13: Tips on How to Have the Greatest Forex Training Possible

Definitely yes, not all beginner traders go to this process, they just get themselves familiar and just jump right in. In the end, the pain and the tears. You have probably heard that 5% of the Forex Traders get profits consistently.

14: Why the Greatest Investment You Can Have is Forex

15: Forex - A Rewarding Money Potential: How to Make it Build you Wealth.

16: Will I get rich from Forex? Definitely! Are you ready to learn?

17: Online Currency Trading requires Patience

18: Forex - What is it?

19: Short data about the origin and development of the currency exchange market

20: Risks by the foreign exchange on Forex

CERTAIN RISKS THAT ARE ASSOCIATED ARE LIKE:-

- The fraud and Scams in Forex market .

- There's risk of losing your whole investment!

- The market sometimes moves against you!

- There is no main marketplace!

- You are relying on the dealer's reputation credit reliability

- There's a risk of the trading system break down!

- You can become a fraud victim!

XE.com

FXConverter by OANDA.com

Yahoo! currency converter

X-Rates.com

The XE service offers currency conversions for one of the most comprehensive list of currencies, from the U.S. dollar, to Slovakia Korunys and India Rupees.In fact, the site is so popular and easy to use that The Times magazine named the converter tool world’s second most useful website in August, 2003.The rates XE uses are based on live mid-market rates, meaning they are derived from the mid-point between buy and sell rates for a currency pair.

Most Popular Foreign Currency Exchange Rate Converter – FXConverterOANDA, one of the more popular currency related sites, has an online service which offers currency exchange rates. The service is one of the most comprehensive around, with available rates for 164 different currencies around the world.In addition, you can customize the interface language to one of the following:EnglishGermanFrenchItalianPortugueseSpanishSwedish

Most Popular Foreign Currency Exchange Rate Converter – YahooYahoo, as part of its uniquely wide financial online services, offers currency conversion tool. The tool is very simple to use, you just choose currencies, the the amount to convert.The output is a current conversion rate, plus you get a graphical chart of the currency’s recent (past few month’s) development in the interbank market.

Most Popular Foreign Currency Exchange Rate Converter – X-RatesThis exchange conversion offers several easy to use tools. For one, you can get FX rate conversion results on a table format against major world currencies. You can also find graphs of the most popular currency pairs with a few clicks of the mouse.The site also features historical rates as far back as 1990.

Price shading is a practice used by forex brokers when they think that the price of a particular currency is on a rising trend. In this case, the broker may choose to add a pip or two to the currency quote. This gives a broker an advantage over its customers. Fortunately, this practice doesn't have to be a strike against traders. Read on to learn more about shading and what you can do to limit its effects if it's happening in your account.

What Is Price Shading?

Before we get into the details of price shading, it is important to remember some background information regarding the forex spot market.

The forex spot market is an interbank market. Banks trade with and among each other. Therefore, prices are created according to the bids and offers of the largest and most liquid banks in any one particular currency. This type of trading is neither regulated nor available in a formal exchange such as a stock market. Therefore, the spot forex market is also referred to as an over-the-counter market. (For more insight, see The Foreign Exchange Interbank Market.)

The interbank prices of currencies are displayed as streaming prices on terminals, such as Reuters or Bloomberg. All the major banks, hedge funds, forex traders and multinationals use these prices to trade with each other. (Learn about the forex market in our Forex Market Tutorial.)