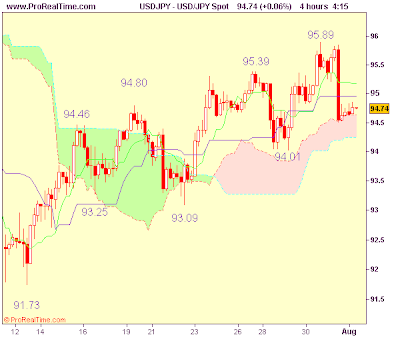

Trade Idea: USD/JPY - Sell At 95.50

Despite rising to 95.90 last week, the subsequent sharp retreat from there on Friday suggests a top has been formed there and correction to 94.01 support is likely, however, the greenback should find renewed buying interest above 93.81 (50% Fibonacci retracement of 91.73 to 95.89) and bring a rebound later but said resistance should continue to hold and bring another decline.

In view of this, we are still trading both sides of the market, buy on further fall towards 94.01 or sell on recovery to 95.40. Only a clear break of 96.15/20 (the confluence of 100% projection of 91.73 to 94.80 measuring from 93.09 and 61.8% Fibonacci retracement of 101.45 to 91.73 at 96.16) would extend recent upmove to 96.60/70. Below 93.81 would indicate the rise from 91.73 is over, then decline towards 93.09 support would follow.

Trade Idea: GBP/USD - Buy At 1.6665

Recent upmove gathered momentum after breaking 1.6587 resistance last Friday and the British pound rose to as high as 1.6780 this morning before easing. Friday’s rally caused the Tenkan-Sen to cross above the Kijun-Sen, providing a buy signal and although pullback to 1.6665/70 cannot be ruled out, the Tenkan-Sen (now at 1.6626) should hold and bring another upmove later towards 1.6830/40 but price should falter well below 1.6915 (100% projection of 1.5983-1.6587 measuring from 1.6338)

In view of this, we are still looking to buy cable on pullback and only a clear break below 1.6627 (50% Fibonacci retracement of 1.6474 to 1.6780) would defer this bullishness and risk correction towards the Kijun-Sen (now at 1.6559) which is likely to hold from here.

BSE Picks Up 15% in United Stock Exchange

The Bombay Stock Exchange (BSE) has revealed that it has purchased 15% stake in the United Stock Exchange (USE), a new entrant in the currency derivatives space.

The sources said that the company, which is having a paid up capital of Rs 150 crore, will now function as a BSE group company. BSE's investment will be Rs 22.5 crore, a 15% of the paid-up capital.

The sources further added that HDFC, Bank of Baroda, Federal bank, Union Bank of India, Allahabad Bank and Bank of India are existing shareholders of USE.

0 Comments

Add A Comment